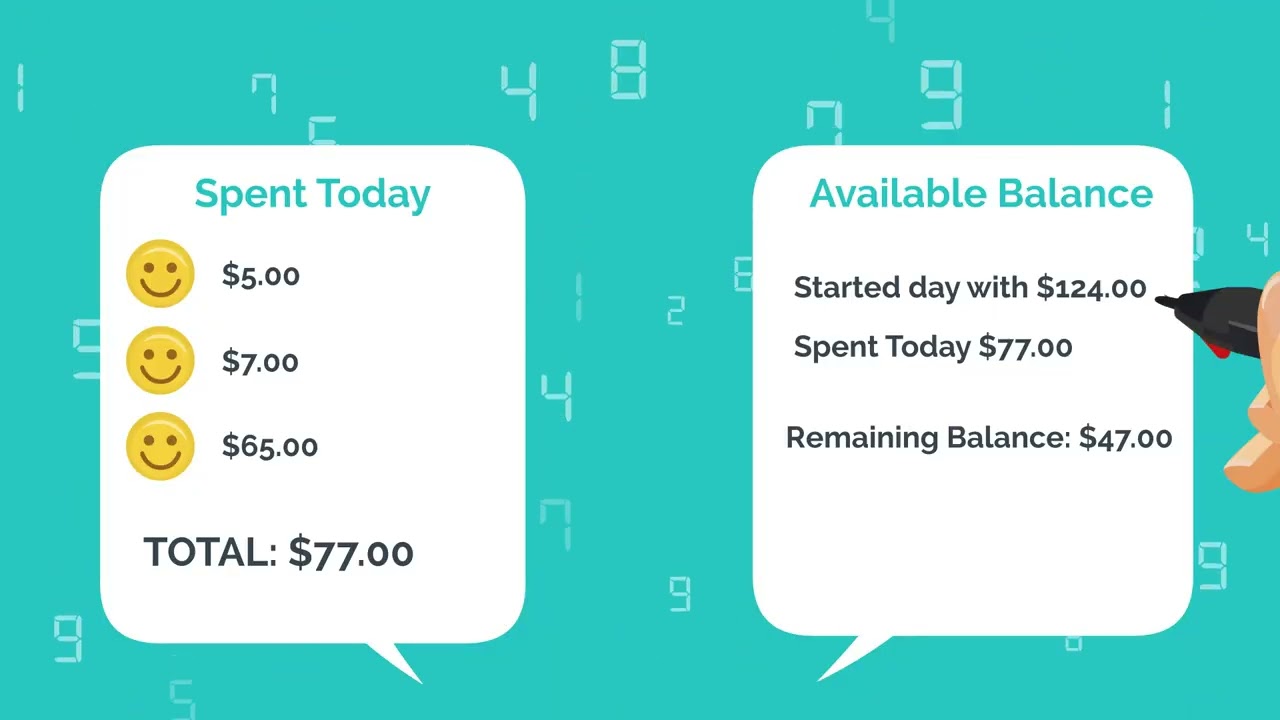

Overdraft Services help you pay for your expenses even if you don’t have sufficient funds in your checking account to cover them. We offer three types of overdraft services:

Overdraft Protection

If you write a check or use your Debit or ATM card and don’t have the money in your checking account to cover the expense, don’t worry! You can have the money automatically transferred from your savings account to cover the transaction. This service is easy and convenient and always available as long as there is money in your savings account.

| What accounts are eligible? | All personal accounts for members 18+ are eligible for the Overdraft Protection. |

| How to opt-in/opt-out? | Call us at (713) 864-0959, send us a secure message via HTFFFCU Online/Mobile or email us at info@htfffcu.org. We will forward you the Overdraft Protection Opt-In/Opt-Out Form. |

| What happens when this service is removed from my checking account? | When an item is presented and there is not sufficient funds, the item may be sent back unpaid with a fee charged to the account. For recurring debit card transactions, the transactions may be paid with a fee. |

| How to check if Overdraft Protection is already on my account? | Call us at (713) 864-0959, send us a secure message via HTFFFCU Online/Mobile. |

| What are the fees to use Overdraft Protection? | There is $1 fee to use Overdraft Protection. The first five (5) transfer each month are reimbursed to the member on the last day of each month. |

Overdraft Tolerance

This service occurs when you do not have sufficient funds in your account to cover a transaction but the credit union pays for the transaction regardless. As part of our Overdraft Tolerance service, the credit union will cover up to $500 per checking account. Overdraft Tolerance is automatically added to your eligible checking account unless you opt out.

This service is available towards recurring debit card transactions, check presentments and debits through the Automated Clearing House (ACH). Members will not have access to Overdraft Tolerance by using debit cards for non-recurring transactions or by withdrawing money from ATM terminals. Additionally, the discretionary Overdraft Tolerance limit will not apply to any checks presented at Houston Texas Fire Fighters Federal Credit Union’s teller windows or drive-thru lanes at any branch location.

After Overdraft Tolerance is used, you must bring your checking share balance positive within 30 days. If you don’t follow through, further Overdraft Tolerance transactions would not be permitted and all your checking accounts will be removed from the Overdraft Tolerance program.

| What accounts are eligible? | All personal accounts for members 18 + that meet the following criteria1 are eligible for Overdraft Tolerance: 1. You must open a checking account. 2. Your mailing address must be up-to-date in our system. 3. You cannot have any defaults on any loans or other obligations. |

| How to opt-in/opt-out? | Overdraft Tolerance is automatically added to your eligible checking account unless you opt out. To opt-out, call us at (713) 864-0959, send us a secure message via HTFFFCU Online/Mobile or email us at info@htfffcu.org. Your request will be processed without any additional paperwork needed. |

| What happens when this service is removed from my checking account? | When an item is presented and there is not sufficient funds, the item may be sent back unpaid with a fee charged to the account. For recurring debit card transactions, the transactions may be paid with a fee. |

| How to check if Overdraft Tolerance is already on my account? | Call us at (713) 864-0959, or send us a secure message via HTFFFCU Online/Mobile. |

| What are the fees to use Overdraft Tolerance? | There is a $28 fee assessed when Overdraft Tolerance is used and it will count against the established limit that we would pay towards your transaction. There is, however, no fee if you never use the service. |

Debit Card Overdraft

Debit Card Overdraft is an optional service for your checking account that allows us to cover your insufficient funds items on non-recurring debit card transactions, whether you complete them at the location of purchase or remotely.

There is a fee associated with the service, and it has been tiered, depending on the transaction amount.

| What accounts are eligible? | All personal checking accounts for members 18+ are eligible for Debit Card Overdraft. | ||||||||||||||

| How to opt-in/opt-out? | Complete this form and email it to info@htfffcu.org, mail it to P.O. Box 70009 Houston, TX 77270-0009,or drop it at any of our three branches. Call us at (713) 864-0959. Alternatively, send us a secure message via HTFFFCU Online/Mobile. Requests will be processed within 24 hours. |

||||||||||||||

| What happens when this service is removed from my checking account? | When you use your debit card and there is not sufficient funds to cover the transaction, it will be declined. If you go to an ATM to withdraw funds and you do not have sufficient funds, the transaction will also be declined. | ||||||||||||||

| How to check if Debit Card Overdraft is already on my account? | Call us at (713) 864-0959, send us a secure message via HTFFFCU Online/Mobile. | ||||||||||||||

| What are the fees to use Debit Card Overdraft? |

|

Additional eligibility requirements: You must be at least 18 years old (teen accounts are ineligible). You cannot be subject to any legal or administrative order or levy. Not available for Business, Association, Trust or similar type checking accounts. Must bring checking account balance positive within 30 days. Read Your Responsibilities For NSF and Overdrafts. Read more in Overdraft Tolerance Policy Disclosure.